Main themes

Retail Financial services

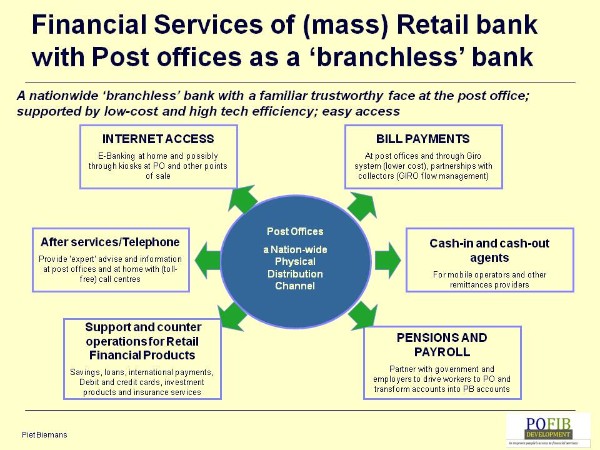

Pofib offers specific expertise in developing and improving (postal) financial services (PFS) and modern (mass) retail financial services, including ‘micro finance’ services in the broader sense.

Summarising: The existing post office counter transactions and new services for modern financial services can and should develop into the ‘business foundation’ of a sustainable post office network and can improve accessibility to modern financial services for all people in all regions.

The use of retail financial services in a society is strongly determined by the culture and payment behaviour.

For that reason it is crucial to make for every society an integrated analysis of the complete set of existing and future (mass) retail financial services solutions.

The migration intensity from cash based payment behaviour into more transfer and account based financial services is difficult to predict.

Per country no situation in this sector is the same, although some characteristics of the (mass) retail financial services market in developing countries are often present.

These characteristics are:

- domestic financial transactions are still mainly cash often handled by the post offices;

- an important volume of non-local currency in society, often from international remittances, ;

- International remittances, through formal and informal channels, incoming and outgoing, often are a strong growing ‘income and cash stream’ ;

- the need for a full package of modern and efficient mass-retail financial services ;

- growing attention for delivering mass retail financial services of non-banking institutions such as micro finance institutions, mobile service operators and retail agent networks;

- domestic transfers via the mobile phone are a strong growing service via mobile operators often in co-operation with financial sector parties and other stakeholders.